What I’m Doing In Markets

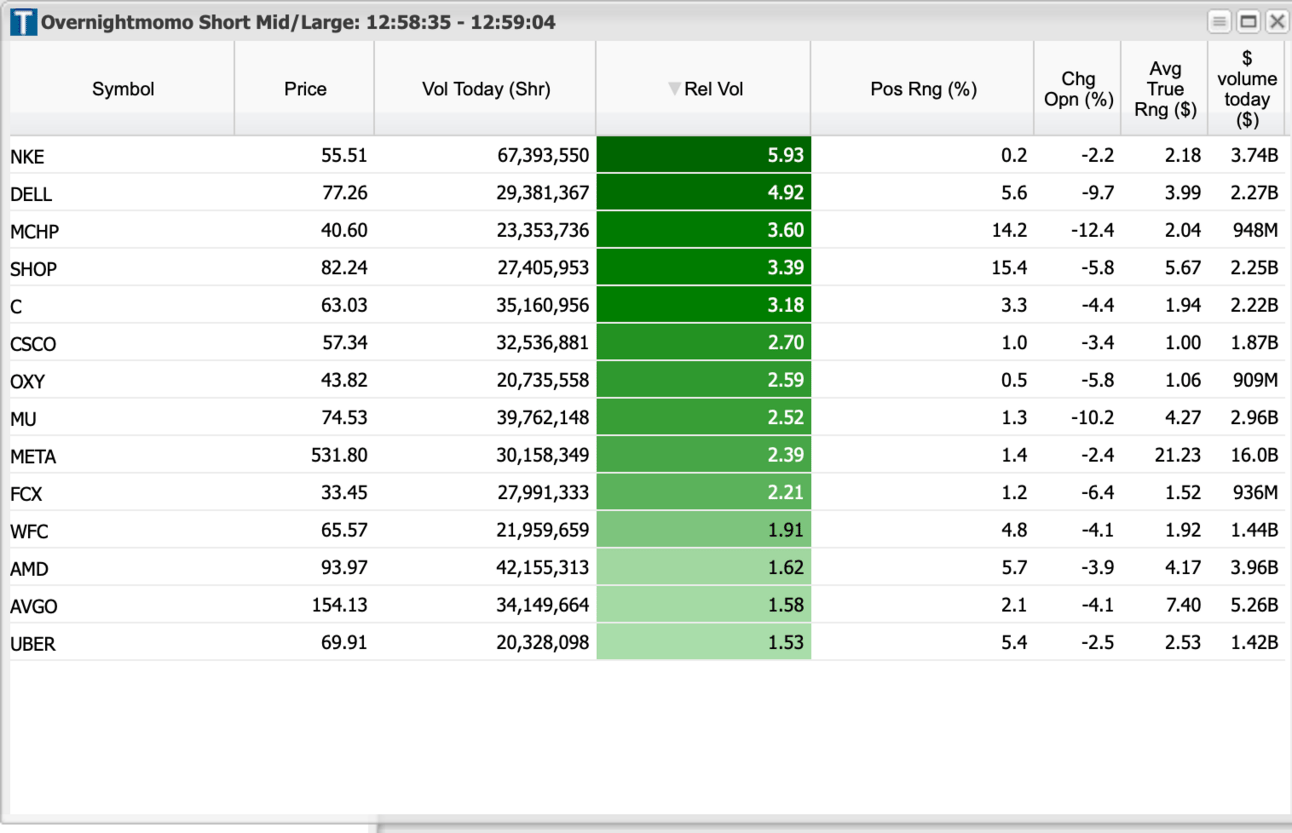

We are back to a trending down environment (3/3 indices are 1% below the 9 day) and I believe we will see some good follow through overnight in the market and in some momentum rich names to the downside and a potential capitulation style trade tomorrow that we then can reverse. As a result, there are a few names overnight on the short side that I find compelling that are listed below in the “Overnight Momo Short Mid/Large Caps” section of this newsletter.

I am personally taking $AMD out short as although there are quite a few names to choose from, $AMD broke below its recent lows today after recently rallying back to $116. I think we could see some nice range expansion on the name overnight, and then a potential capitulation style trade in which I will flip long.

INDICES READING:

>=2/3 indices are trending up = Focusing on overnight longs

>=2/3 indices are trending down = Focusing on overnight shorts

>=2/3 indices are range bound = No overnight trading

*Highlighted bold is where we are at in the market.

*Documentation explaining what this reading is and my overnight momentum trading system: Click Here

OVERNIGHT MOMO SCANS:

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. Always do your own research and consult with a licensed financial advisor before making any investment decisions. “We”, “I”, “SaveOnTrading, or “Overnightmomo” may buy or sell any security mentioned at any time, without notice.